Invoice Compliance and Correction

Learn about VCS invoice compliance and how to correct your invoices.

VAT invoices must comply with applicable laws. Refer to Invoice compliance for the minimum legal requirements.

If you make an error on an invoice, you can correct it and upload the amended version. For more information refer to Invoice correction.

Invoice compliance

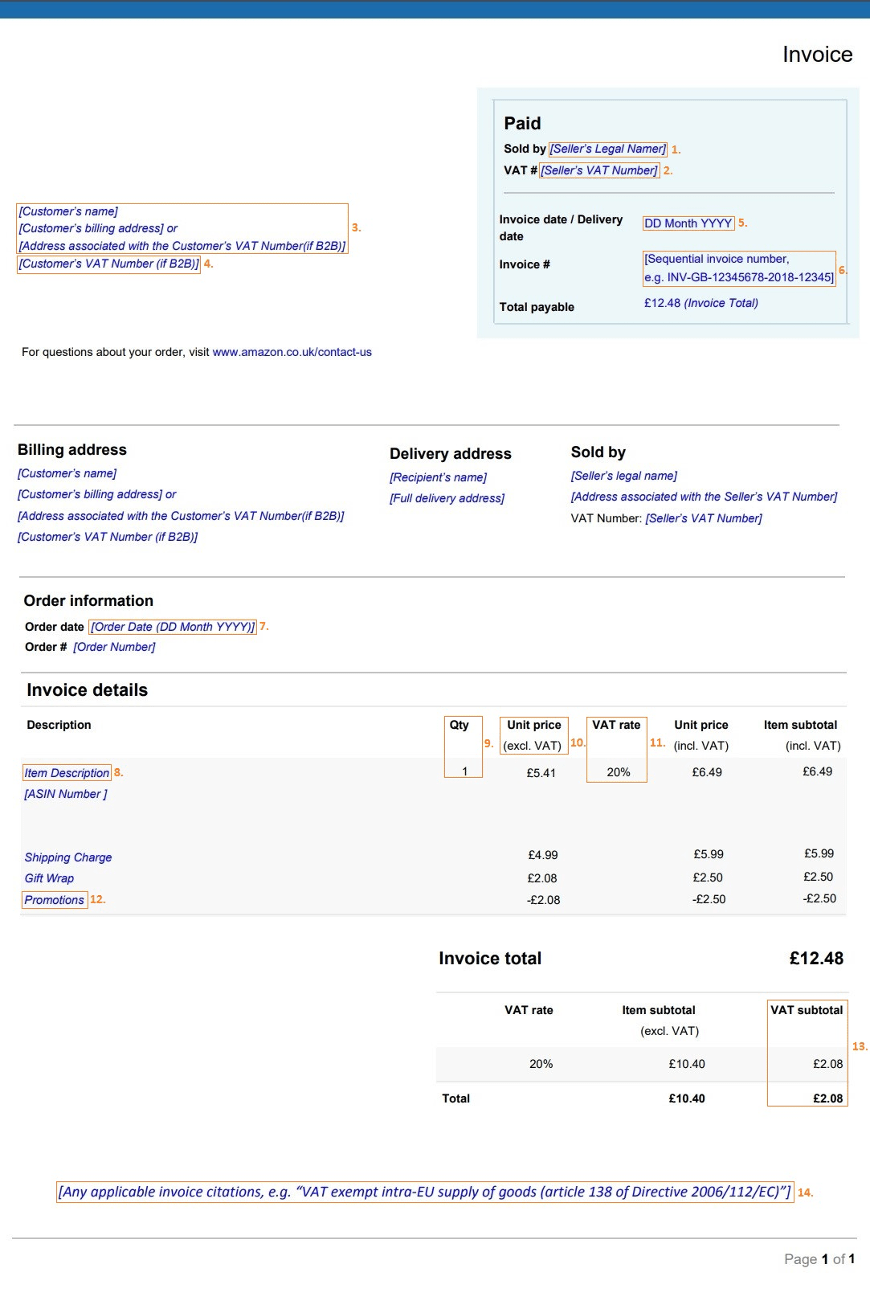

At minimum you must include the following information on an invoice:

-

Registered company name and address of the seller

-

VAT identification number of the seller (if applicable)

-

Complete official name and address of the customer

-

VAT identification number of the customer

- This is only necessary if the customer is responsible for the tax in the purchase order (for example, for intra-community delivery or reverse charge procedures).

- This number is provided in the VIDR.

-

Invoice date/service date

-

Invoice number

-

Order date

-

Product name

-

Purchase quantity

-

Unit price of the item (without VAT)

-

VAT rate applied

-

Discounts/promotions, if not included in the unit price

-

VAT amount

-

Citation

Sample invoice

The sample invoice format is only for guidance. You can choose the format, logo. Follow these best practices for a positive customer experience and a trouble-free process:

- Do not include bank details (to avoid direct bank transfers to you).

- Do not include payment status, such as paid or not paid.

- Provide order-related fields, such as order number, product category, or purchase order number.

For additional information, contact your tax advisor.

Invoice correction

Customers can contact Amazon's Customer Service to correct an invoice that is uploaded by a seller using VCS. Sellers who have opted to upload their own invoices using VCS data receive the correction data through the VIDR, and must upload a credit note for the original transaction and a new invoice for the corrected transaction. Customers can request an invoice correction only when they want to change the billing address or the billing name (no other corrections are supported). When Customer Service confirms a correction, two new transactions are created and listed in the VIDR:

-

Reversal transaction to negate the original transaction. The shipment ID of this reversal is the shipment ID of the original transaction. The transaction ID of this reversal transaction is a new ID, in this format:

CorrectionReversal:X:XXXXXXXXX. The transaction type isREFUND. The seller must upload a credit note for this transaction. Because a transaction ID is required for refunds, the seller must provide a transaction ID during credit note upload. If there is no transaction ID, the credit note is rejected. -

Corrected transaction. The shipment ID of this corrected transaction remains the same as the shipment ID of the original transaction. The transaction ID of this corrected transaction is a new ID in this format:

Correction::X:XXXXXXXXX. The transaction type isSHIPMENT. The seller must upload a new invoice for this transaction. Transaction ID is required when uploading an invoice for a corrected transaction. If there is no transaction ID, Amazon isn't able to determine if the invoice is for the original shipment or for the corrected transaction and rejects the invoice upload.

Because Amazon only supports the correction of billing name and billing address, the amounts remain the same for the original transaction and the corrected transaction.

Note

Uploading corrected invoices and credit notes for corrections are not included in Invoice Defect Rate calculations. Therefore, any delay in uploading invoices and credit notes for these transactions won't have a negative impact on a seller's Invoice Defect Rate.

Partial refunds with VAT-exclusive prices

Always send partial refunds VAT-exclusive. Whether you use feeds (XML or flat files) or Seller Central, you must use VAT-exclusive prices. Amazon uses the VAT rate that was applied for the original shipment and calculates the VAT based on the VAT-exclusive price.

For example, if the VAT is 20% and the item cost was €240 (€200 + €40 VAT@20%), and you want to refund 50% (€120) then you need to specify €100 in the Product field and Amazon adds the VAT (€20), ensuring that the customer gets €120.

Do not include any value in the Product Tax, Shipping, and Gift Wrap fields, as Amazon ignores these values.

Updated 3 months ago